Personalized Discovery on Credit Karma

I led a full homepage redesign and launched a new personalized feed that reinvented navigation, growth, and discovery on Credit Karma, one of the most downloaded financial apps in the US. This was a critical initiative to drive user growth, engagement, and retention by supporting our rapidly expanding product portfolio and accelerating the growth of new and emerging vertical lines of business.

My role

⏵ Business case

⏵ Product strategy & roadmap

⏵ Product scope and requirements

⏵ Led team on all phases of execution

⏵ Led go-to-market, scaling, optimization

Core team

⏵ 6 frontend/backend engineers

⏵ 2 designers

⏵ 1 product analyst

⏵ 1 growth marketer

⏵ 1 product legal counsel

Delivery

⏵ 2 months MVP & experimentation

⏵ 8 months from inception to fully scaled

Problem

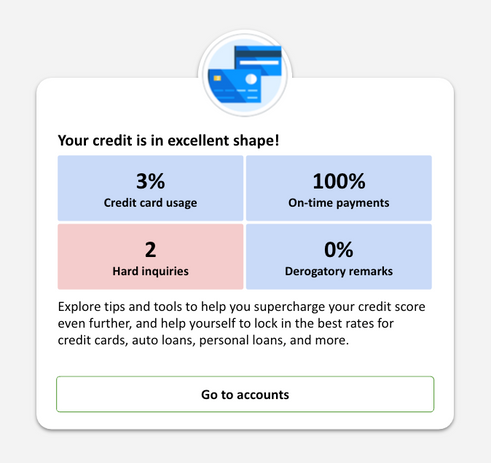

Credit Karma was famous for free credit scores, but we had a lot more products and features to offer our members across their financial journey. For example, in the areas of Home and Auto, we were helping our members with the problem of overpaying thousands of dollars on their loans, and we needed to grow these emerging verticals. Expanding our product portfolio was pivotal to growing our active user base. While credit scores and Credit Cards carried us for years, slowing growth showed that we needed to diversify.

However, we faced a big discovery problem. How do we take Credit Karma beyond the credit score and our core Credit Cards product? The majority of our users surveyed were not even aware that we had anything beyond credit scores. 60% of users were not going beyond the homepage. And our legacy navigation and discovery architecture were not doing the job. We historically relied on a horizontal nav bar whose impact was getting maxed out after endless cycles of tweaks and optimizations. We also presented a more prominent carousel that highlighted a range of products and features in a more contextualized manner, but users were not engaging.

We knew we needed to more drastically rethink our strategy and design in order to maximize the connection between our members and all the products we offered. To unlock growth and revenue across all verticals, and to diversify Credit Karma's business.

Evolution #1: Ribbon navigation with horizontal scroll

-

Reasonably effective when there were fewer verticals

-

Engagement beholden to top placements, stifling diversification

-

No helpful context to capture user attention, creates user confusion, accidental clicks

-

Very low horizontal scrolling action to unlock discovery beyond the fold

Evolution #2: Fully locked menu display

-

Alleviated dependence on scrolling for discovery, but now many verticals are competing for attention

-

Problem persists of having no helpful context to capture user attention or reason to click, creates user confusion

-

Pushed key content such as credit scores and card offers further below the fold, negatively impacting revenue and credit report engagement

Solution

We completely broke free from the constraints of the traditional nav bar and horizontal carousel, and moved to a vertical scrolling homepage feed. A project that internally we aptly named Tall Phone. It was a somewhat natural evolution based on our learnings up until this point, as well as aligning with a paradigm that was becoming the industry standard. Nevertheless, to do it right and to do it effectively, it would prove to be a very complex endeavor. The new personalized feed comprised of 2 main concepts:

-

The Story was the building block for the feed. It was a package of highly personalized information presented to the user. Adhering to a centralized set of design templates, Credit Karma business users from any vertical team could create, configure, and launch their own stories, all outside of a dev build/release. Furthermore, stories could just as easily be dropped onto any page, not just the homepage.

-

The feed, aka Tall Phone, was a collection of stories on the homepage, driven by our Recommendations engine - completely automating a personalized experience for every single one of our 130 million users, and optimizing towards key engagement and revenue metrics. No one person had the same exact feed, and your feed constantly evolved every time you logged in.

Solution Validation

Strategic Goals

-

Keep things fresh: Every story was personalized, dynamic, and actionable. The data, status, and urgency of each story was constantly changing.

-

Create a scalable system of managing the homepage feed. Eliminate the need for the Core Product team to be the manual gatekeepers of every new requirement and decision.

-

Actualize diversification through the homepage feed: Optimizing for both engagement and revenue, and growth targets across all verticals.

Tactical Approach

-

Conducted user research and product analysis to inform design direction.

-

Kicked off the initiative with a design sprint with cross-functional stakeholders.

-

Developed a roadmap with key milestones and metrics to hit for continued investment.

-

Developed a proof of concept and ran it as an experiment: iOS only, manually created a small set of stories in partnership with select verticals (Home, Auto).

-

Developed a system to create and manage stories at scale.

-

Built up a minimum inventory of stories prior to official launch.

-

Integrated the feed with our Recommendations engine for personalization and optimization at scale.

Success Metrics

-

Monthly Active Users: By creating a much more contextualized and personalized navigation and discovery experience, we aimed to drive a significant % lift in sitewide MAU.

-

Revenue: By improving engagement and in turn conversion with emerging verticals, we anticipated some cannibalization against core Credit Cards revenue, but a lift in overall revenue. Also focused on vertical-specific revenue targets.

-

Feature Usage: A key motivation for this initiative was to improve discovery, to take users beyond the credit score (n+1), and to significantly reduce the 60% of users not making it past the homepage.

Impact

-

Launched redesign across Android, iOS, Desktop & Mobile Web

-

Personalization & optimization powered by Recommendations engine

-

Scaled to all 130 million users

-

Drove 5% lift in sitewide MAU

-

Unlocked X% growth across Home, Auto, Personal Loans, Tax verticals

Retrospective

We faced a very unique challenge when integrating the Recommendations engine into the homepage feed. Historically, the engine was scoped and designed purely to maximize revenue generated by our Credit Cards vertical. But now we had to expand its scope to help grow additional verticals, even if it came at the cost of Cards revenue to some extent. We were also committed to give attention to new features that primarily helped drive engagement (like the credit score, debt payoff calculators, and more). Thus, this became much bigger than a homepage redesign. It forced us to evolve as an organization and think more holistically and long term about the balance between engagement and revenue, and having shared ownership across Core Product and all other vertical teams.